Predictive Analytics - Introduction: Time series analysis

Question to answer

- Will a person buy a house? – Yes or no.

- How much will he pay for a house? – Amount of dollars.

- When will he buy a house? – A date.

- How long will he keep looking for a house? – Length of time period.

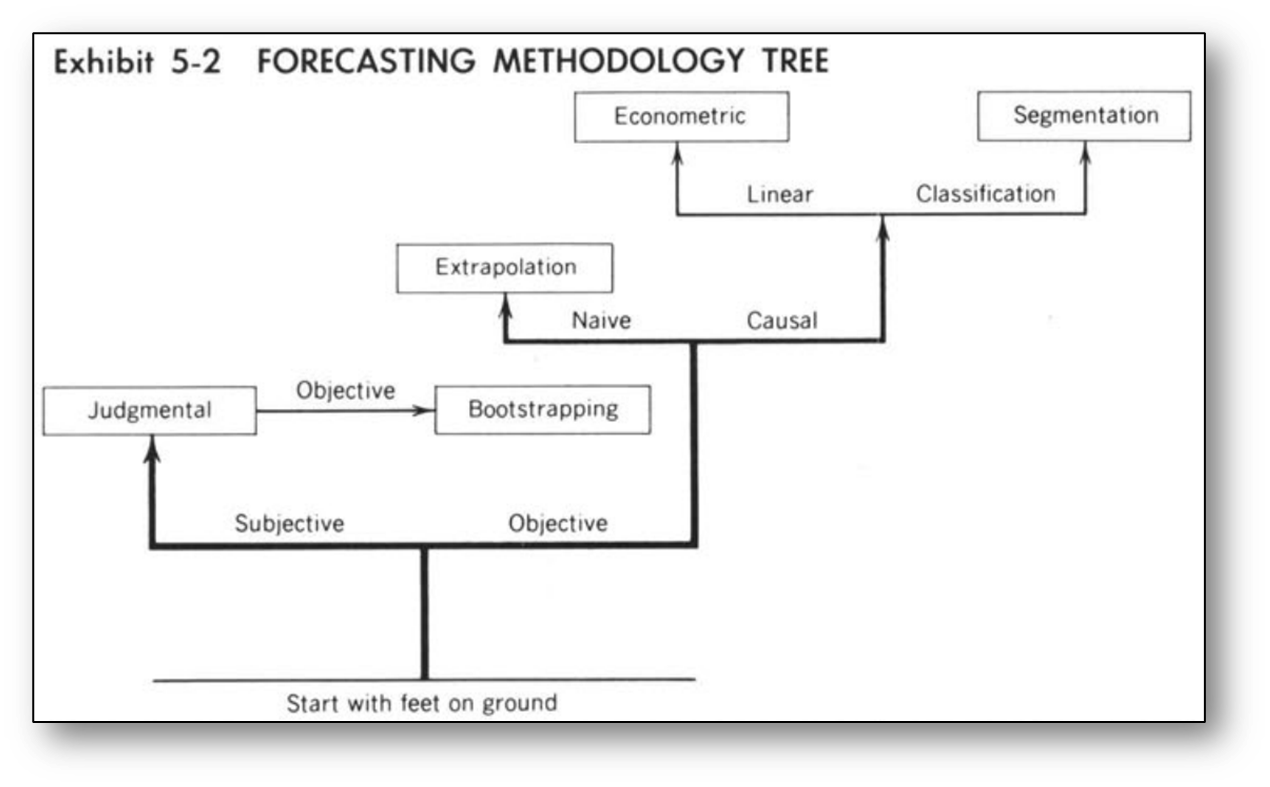

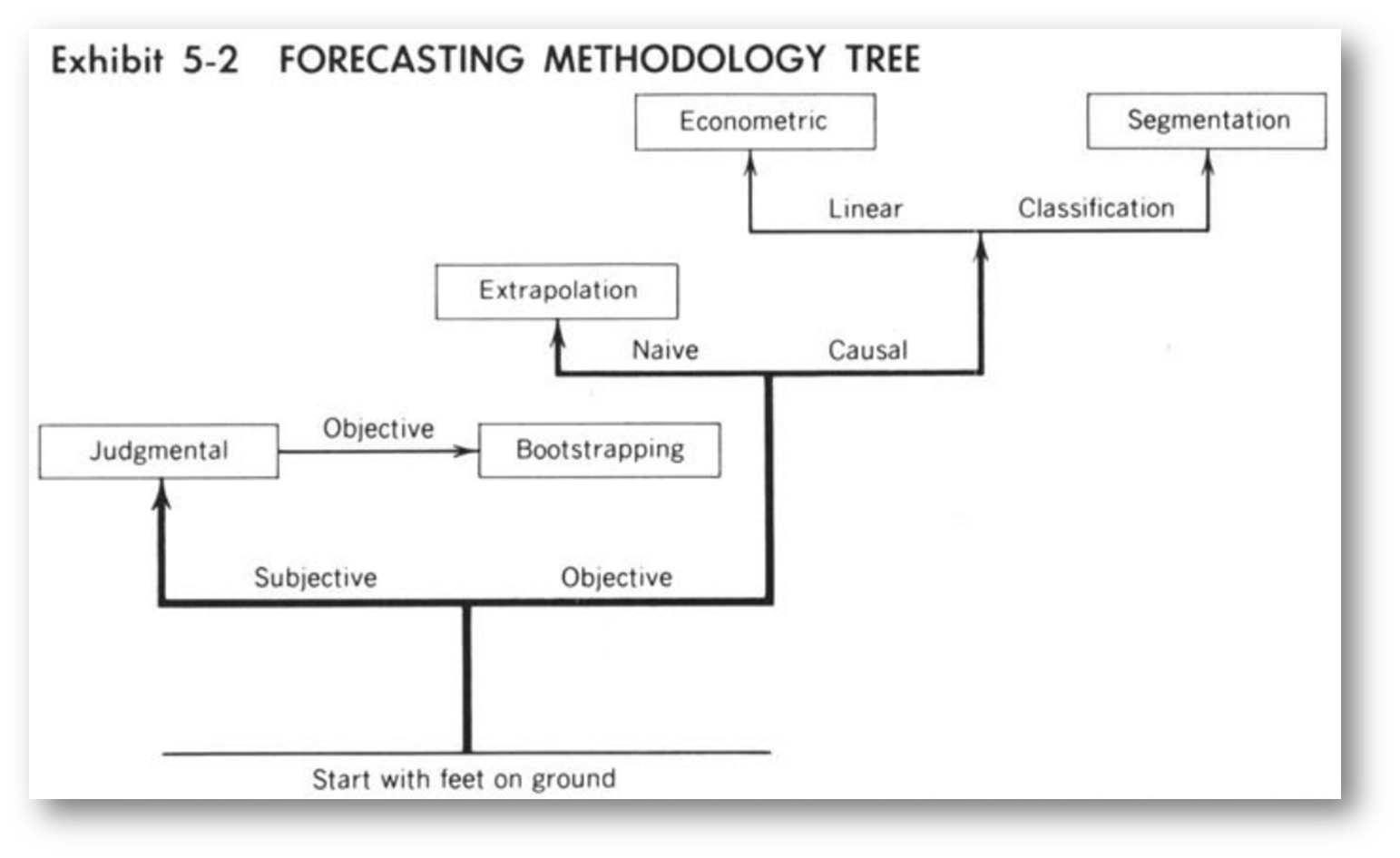

Types of Predictive analytics

- Objective methods:

- Causal models

- Time series

- Artificial Intelligence (AI)

- Subjective methods:

- Composites

- Surveys

- Jury of executive opinions

- The Delphi method

- Prediction or information markets

- Combined Methods

Subjective forecasting

Qualitative methods

Also called: implicit, informal, clinical, experienced-based, intuitive methods, guesstimates, WAGs (wild-assed guesses), or gut feelings.

Aggregation of expert opinions:

- Sales Force Composites – aggregation of sales personnel estimates

- Jury of executive opinions

- Surveys – customer surveys, political elections polls

The Delphi Method

- Interactive forecasting method which relies on a panel of experts

- The Delphi method is based on the assumption that group judgments are more valid than individual judgments

- Key characteristics:

- anonymity of participants;

- structuring of information flow;

- regular feedback;

- role of the facilitator.

Combined methods

- Increase a number of experts

- Take implicit subjective method and make it explicit and operational

- Right down rules used by experts to make their decisions and then use bootstrapping to create a huge number of opinions and converge to some decision

Objective forecasting

Based on abundance of data and objective (statistical) methods of data analysis

- Causal models: regression and classification models

- Time series analysis: trend, seasonality, moving averages, smoothing, …

- Artificial Intelligence (AI): Neural networks, Machine Learning, Deep Learning

Business questions:

What would be sales next month?

Will the client renew subscription?

Should the customer be given a home loan?

What is a probability of a customer to default?

What is weather forecast for tomorrow, next week, next season?

Causal models:

Time series analysis:

Artificial Intelligence (AI)

(ARMSTRONC, J. S. (1985). Long-Range Forecasting: From Cristal Ball to Computer (2nd Edn). New York: Wiley-Interscience. )

Time series

invisible(lapply(c("readr", "dplyr", "ggplot2", "tseries"), library, character.only = TRUE))

diet <- read_csv("Diet.csv")

diet <- diet %>% mutate(Date = as.Date(Week, format="%d-%m-%y"), Type="Real") %>% select(-Week)

ggplot(data=diet, aes(x=Date, y=Diet)) + geom_line(size=1)fit <- arima(diet$Diet[1:204], c(0, 1, 1), seasonal = list(order = c(0, 1, 1), period = 52))

pred <- predict(fit, n.ahead = 57)

diet2 <- rbind(diet, data.frame(Date=diet$Date[205:261], Diet=pred$pred, Type="Pred"))

ggplot(data=diet2, aes(x=Date, y=Diet, group=Type)) + geom_line(aes(color=Type), size=1) + theme(legend.position = c(0.1, 0.8))invisible(lapply(c("readr", "dplyr", "ggplot2"),

library, character.only = TRUE))

spx <- read_csv("SP 500 Historical Data.csv")

spx$Date <- as.Date(spx$Date, format="%b %d, %Y")

head(spx)

ggplot(data=spx, aes(x=Date, y=Price)) +

geom_line(size=1) +

scale_x_date(date_breaks = "1 year",

date_labels = "%Y")spx2 <- as.matrix(spx[, c("Open","High","Low","Price")])

rownames(spx2) <- as.character(spx$Date)

library(dygraphs)

dygraph(head(spx2, 50)) %>% dyCandlestick()

head(spx2)x <- data.frame(

Date=seq.Date(as.Date("2015/1/1"),

as.Date("2019/1/1"), by = "day")

)

x$Change <- rnorm(nrow(x), mean=0.0, sd=0.02)

x$Price <- cumprod(x$Change + 1) * 15

ggplot(data=x, aes(x=Date, y=Price)) +

geom_line(size=1) +

scale_x_date(date_breaks = "1 year", date_labels = "%Y")

head(x)Gambler's ruin problem

- Gambler starts with some money

- ‘Fair game’ with 50:50 chance

- Result of each game is up or down $1

- For how long will the player play?

- How much money will he get?

money <- 10

cnt <- 1

while(money[cnt] > 0){

new_game <- sample(c(-1,1), size=1,

prob=c(0.5, 0.5))

money <- c(money, money[cnt] + new_game)

cnt <- cnt + 1

}

print(cnt)Example 1

library(doSNOW); library(foreach)

cl <- makeCluster(6, type="SOCK"); registerDoSNOW(cl)

res <- foreach(i=seq(1,1000), .combine=c) %dopar% {

money <- 10; cnt <- 1

while(money > 0){

new_game <- sample(c(-1,1), size=1, prob=c(0.5, 0.5))

money <- money + new_game

cnt <- cnt + 1

if(cnt > 1000){

break

}

}

cnt

}

hist(res[res < 1000], breaks=50)Example 2

library(doSNOW); library(foreach)

cl <- makeCluster(6, type="SOCK"); registerDoSNOW(cl)

res <- foreach(i=seq(1,1000), .combine=c) %dopar% {

money <- 10; cnt <- 1

while(money > 0){

new_game <- sample(c(-1,1), size=1, prob=c(19/37, 18/37))

money <- money + new_game

cnt <- cnt + 1

if(cnt > 1000){

break

}

}

cnt

}

hist(res[res < 1000], breaks=50)An expected duration of the game:

Trading strategies

library(readr)

library(tidyquant)

bank <- read_csv("CBA.AX.csv")

ggplot(data=bank, aes(x=Date, y=Close)) +

geom_line(size=0.5) + theme_bw() +

ggtitle("CBA stock price") +

geom_ma(ma_fun=SMA, n=50, color="red", size=1) +

geom_ma(ma_fun=SMA, n=200, color="blue", size=1)Finance engineering - synthetic asset

library(readr); library(tidyquant)

CBA <- read_csv("CBA.AX.csv")

WBC <- read_csv("WBC.AX.csv")

pair <- data.frame(Date=CBA$Date,

Return=log(CBA$Close) - log(WBC$Close))

ggplot(data=pair, aes(x=Date, y=Return)) +

geom_line(size=0.5) + theme_bw() +

ggtitle("Pair CBA-WBC")Time series filtering

library(readr); library(dplyr)

CBA <- read_csv("CBA.AX.csv")

renko <- function(pr, H){

res <- data.frame(Time=1, Return=pr[1])

for(i in seq(2, length(pr))){

if(abs(pr[tail(res$Time,1)] - pr[i]) >= H){

res <- res %>% add_row(Time=i, Return=pr[i])

}

}

return(res)

}

ren <- renko(log(CBA$Close), H=0.1)

ren$Date <- CBA$Date[ren$Time]

ggplot(data=CBA, aes(x=Date, y=log(Close))) + geom_line(size=0.5, col="#00BFC4") + theme_bw() + ggtitle("CBA returns") + geom_line(data=ren, aes(x=Date, y=Return), size=1, col="#F8766D") + geom_point(data=ren, aes(x=Date, y=Return), size=2, col="#F8766D")Stock market

- First parameters

- Second parameters

- Third parameters

get_xi <- function(pr){

temp <- sign(diff(pr))

temp <- sapply(seq(2, length(temp)),

function(i) temp[i-1] != temp[i])

return(1 / mean(temp))

}

get_xi(ren$Return)Summary

- Predictive analytics: subjective and objective

- Subjective forecasting:

- Aggregation of expert opinions, Delphi method, Information markets

- Objective forecasting: naive and causal

- Time series - naive forecasting

- Random Walk - impossible to make predictions

- Time series transformation and filtering

Don’t Gamble! …unless you understand the process in details and probability is on your side.